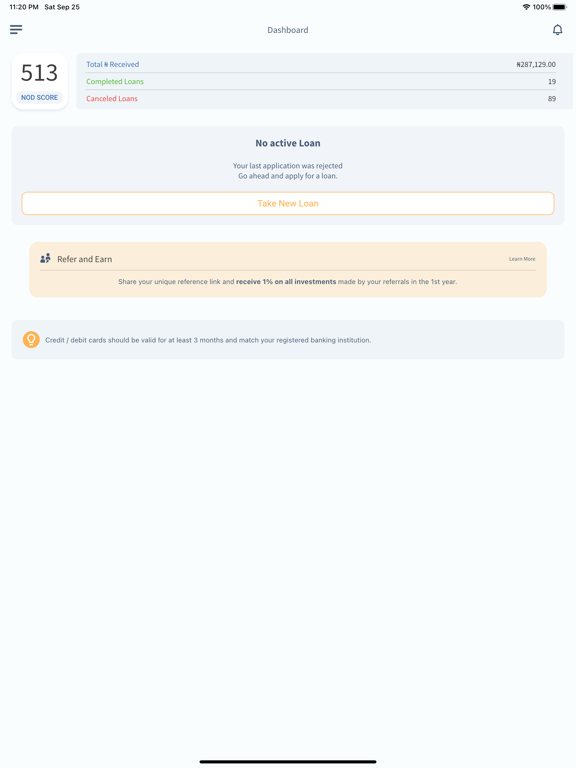

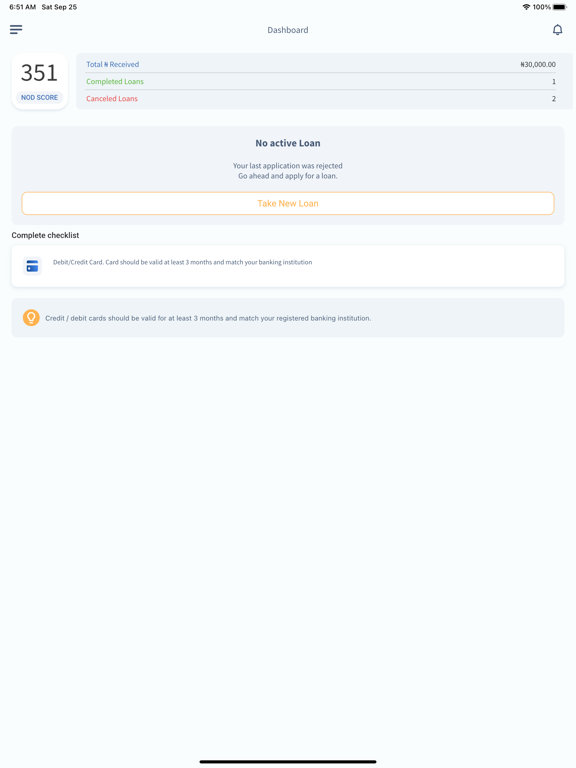

NodCredit offers both employed and self-employed, business persons and corporates quick loans starting from N10,000 to N50,000 for first time borrowers. Returning customers can access upto 300,000.

Our Interest ranges from 1% – 16% per month. For multiple tenors accessible to returning customers we charge on reducing balance at lower interest.

1. Install NodCredit app

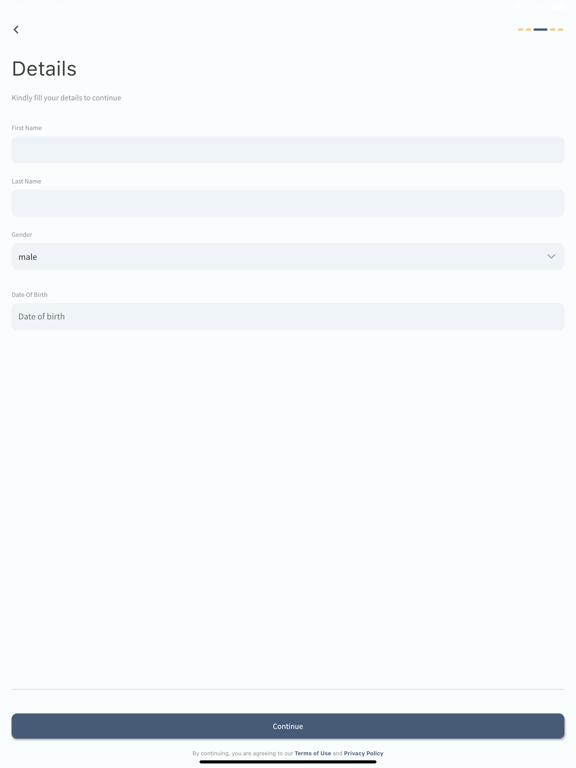

2. Sign up with your BVN. BVN spooled data will be used to pre-populate some of your personal data

3. Add your card (N20 will be charged for card tokenization) and bank account details

4. Apply for your loan

5. Wait for a few minutes.

6. If your loan is approved. You receive cash instantly in your provided bank account.

- Pause Option: you can defer your repayment date for 30 days if you run into any financial difficulties. You can defer for as many times as possible.

- Custom repayment schedule - unlike the other lenders, we allow you settle your loan in split payments, pay parts of your loan whenever you have it.

With an equivalent monthly interest of 1% – 16% and APR (Annual Payment Ratio) of 12% - 96%.

LOAN / REPAYMENT SCENARIO:

- If your loan is for 3-months and your borrowed N150,000, if NodCredit charges you a returning customer interest rate of 10% per month on your reducing balance. You will pay;

- 1st month: N65,000

- 2nd month: N60,000

- 3rd month: N55,000

This is a gross interest rate of 20% and an equivalent monthly interest of 6.6% for each month on your fixed balance of 150,000.

PS: Remember you can also pause the pause and defer payments for another month.